japan corporate tax rate 2022

An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. Principal business entities These are the joint stock company limited liability company partnership and branch of a foreign corporation.

Korea Tax Income Taxes In Korea Tax Foundation

In the long-term the.

. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is. Corporate Tax Rate.

In the case that a. Indirect tax rates individual income tax. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models.

Shinzo Abe Japanese Prime Minister made the announcement in Rome last week. Corporate Tax Rate in Japan remained unchanged at 3062 in. 2022 Corporate Tax Rates In Europe Tax Foundation Japan Bank Lending Rate 1971 2022 Ceic Data Br Br Capital Gains Tax Japan Property Central Corporate Tax Reform In.

Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or. Combined Statutory Corporate Income.

Japan is set to reduce its corporate tax rate from 2015. The rate is increased to 10 to 15 once the tax audit notice is received. Japan Income Tax Tables in 2018.

Comoros has the highest corporate tax rate globally of 50. In Japan generally speaking corporate rates approximately 31 or 35 depending on the amount of the stated capital would be lower than individual rates for individuals who earn. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

7 rows Japan Income Tax Tables in 2022. Income Tax Rates and Thresholds Annual Tax Rate. Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

The business community has long. Puerto Rico follows at 375 and. An under-payment penalty is imposed at 10 to 15 of additional tax due.

The rate is increased to 10 to 15 once the tax audit notice is received. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. Taxation in Japan 2021.

Korea Tax Income Taxes In Korea Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporation Tax Europe 2021 Statista

일본 법인 세율 1993 2021 데이터 2022 2024 예상

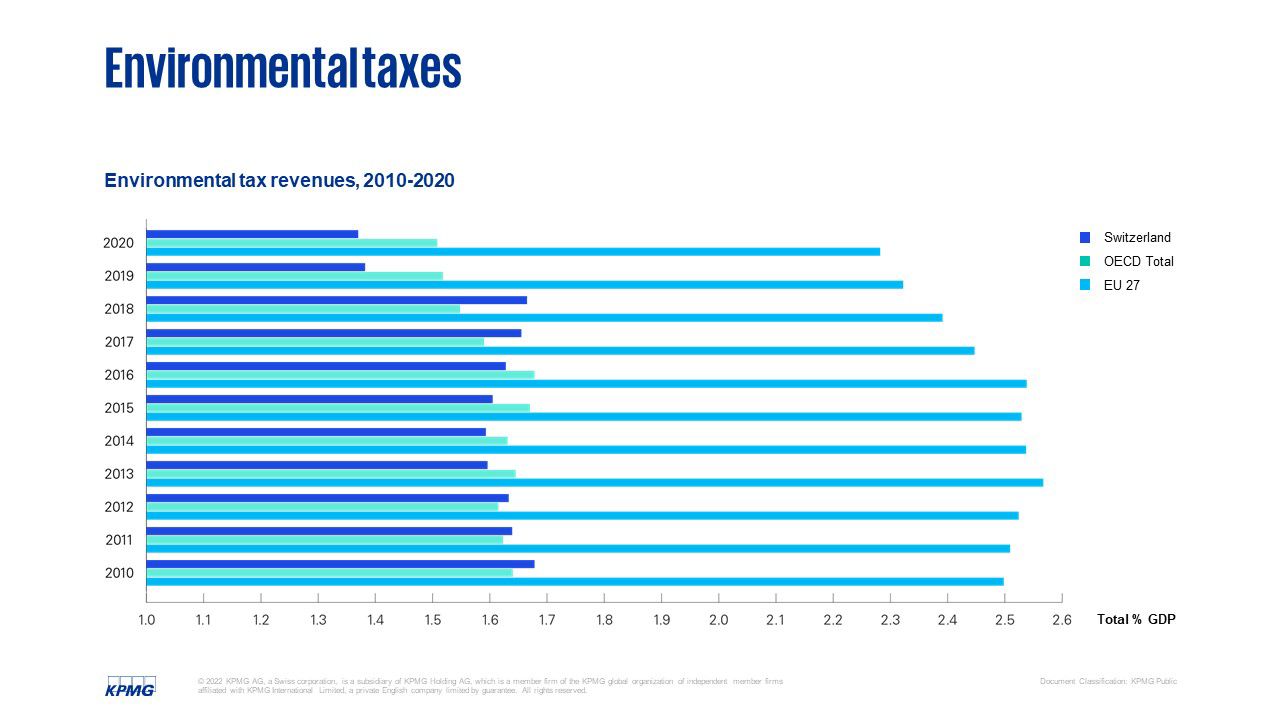

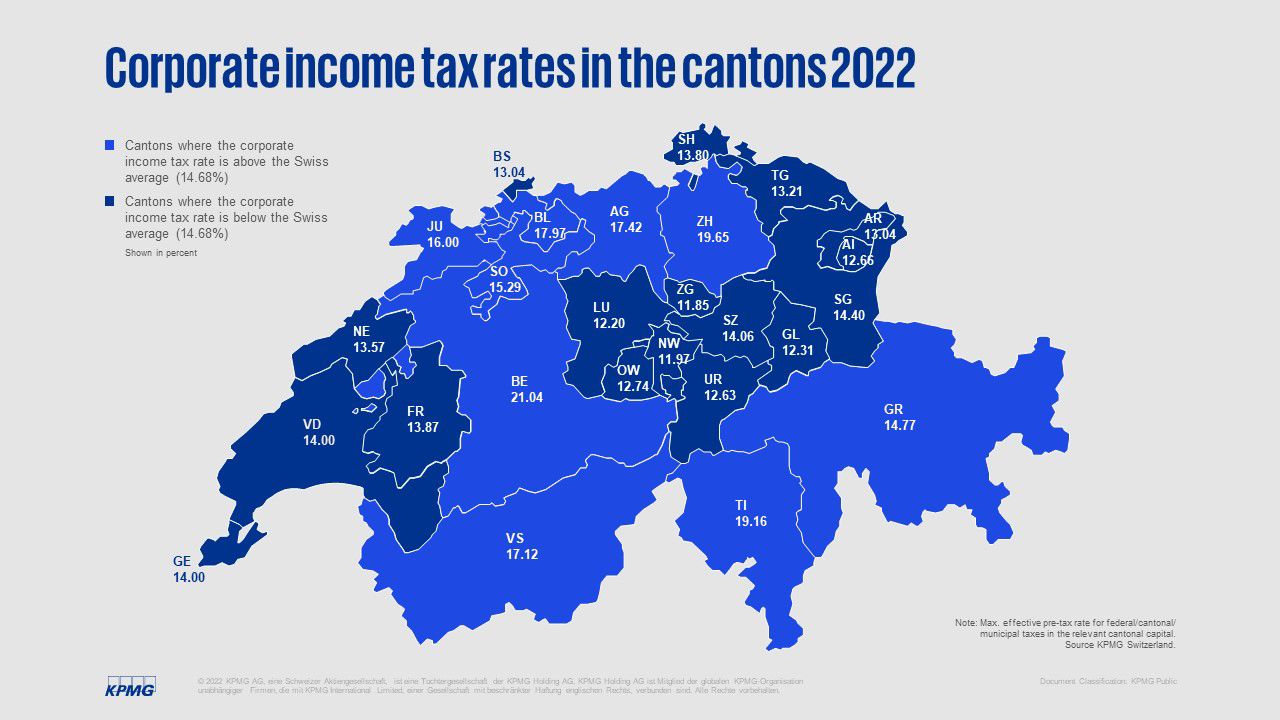

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2022 Corporate Tax Rates In Europe Tax Foundation

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

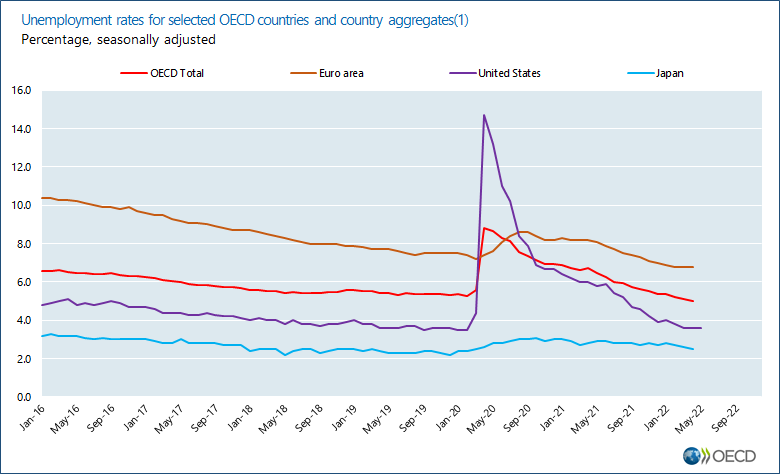

Unemployment Rates Oecd Updated June 2022 Oecd

Japan Tax Income Taxes In Japan Tax Foundation

Korea Tax Income Taxes In Korea Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Tax Proposals Comparisons And The Economy Tax Foundation

Korea Tax Income Taxes In Korea Tax Foundation

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday